how to calculate stock up rate

To calculate your profit or loss subtract the current price from the original price. Just follow the 5 easy steps below.

Investing How Do I Calculate My Average Price For A Share Bought Multiple Times Personal Finance Money Stack Exchange

Annual turnover number of employees who leftaverage number of employees100 Following the same.

. Now that you have your simple return annualize it. Graham Number Square root of 1853 x 15 14839 x 184079. Calculate your simple return percentage.

Average Inventory Inventory at the Beginning of the Period Inventory at the End of the Period 2. Simple Return Current Price-Purchase Price Purchase Price. The justified PE ratio above is calculated independently of the standard PE.

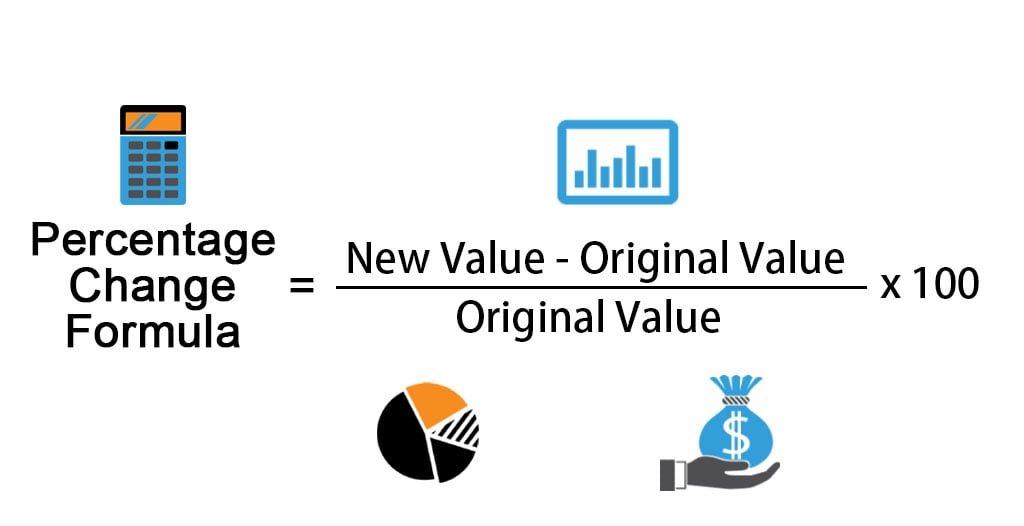

A Rate of Return ROR is the gain or loss of an investment over a certain period of time. The percentage change takes the result from above divides it by the original purchase price. Heres the formula to calculate your turnover rate percentage.

The stock turnover ratio formula is the cost of goods sold divided by average inventory. In other words the rate of return is the gain or loss compared to the cost of an initial. The difference is that 100 of the units on a line must be in-stock for that line to count as in-stock.

Enter the number of shares purchased. In other words we can stay that the Stock Price is calculated as. Enter the purchase price per share the selling price per share.

We can calculate the stock price by simply dividing the market cap by the number of shares outstanding. The Stock Calculator is very simple to use. Finally the formula for a stock turnover ratio can be derived by dividing the cost of.

Accurate and instant information. When Benjamin Graham Formula formula is used to Heromoto the Graham number is as follows. Traders can use the tool to form comparative analysis between different brokers.

An implication surrounding the use of time-series data in which the final statistical conclusion can change based on to the starting or ending dates of. The stock turnover ratio determines how soon an enterprise sells its goods and products and replaces its. CFIs Financial Analysis Courses.

Suppose the particular companys earnings each share happen to be and will continue in order to grow at 15 per year. So if a customer. The advantages of the Upstox brokerage calculator are.

In other words the two ratios should. Many companies will instead measure their line fill rate. By taking the PE proportion and dividing this by the growth rate the PEG.

What Is A Stock Up Price The Krazy Coupon Lady

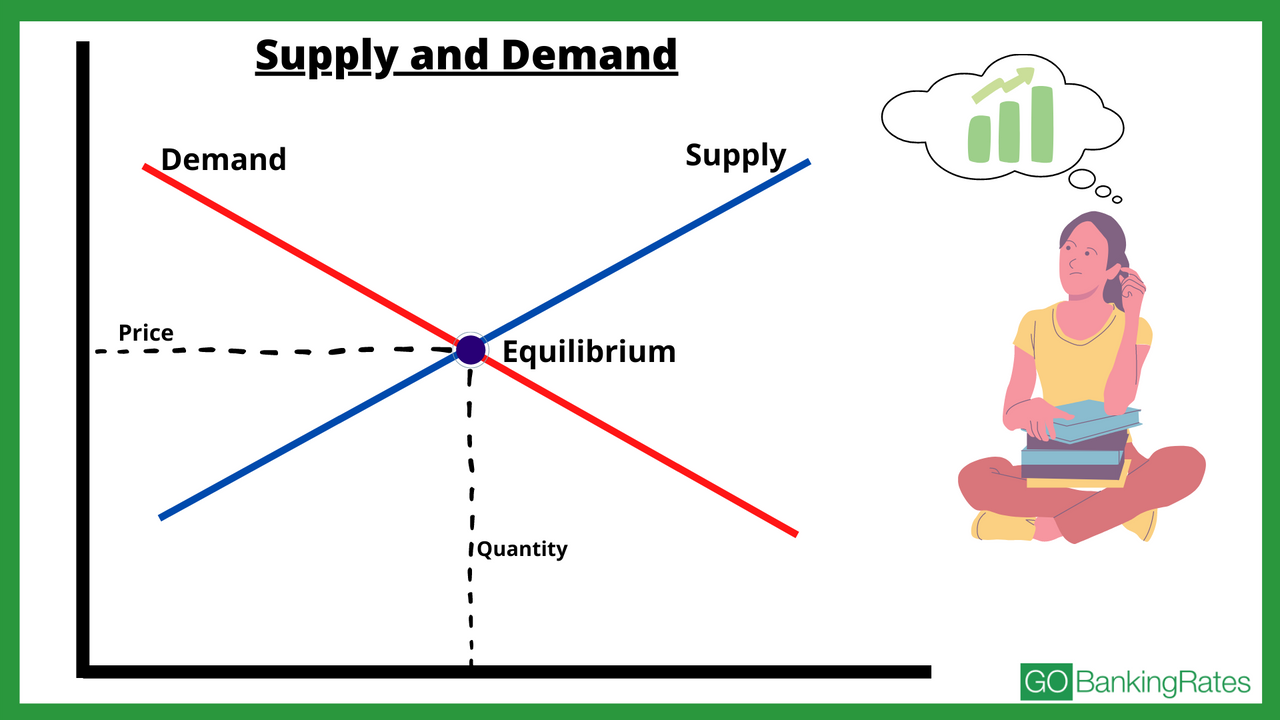

What Makes Stock Prices Go Up Or Down Here Are The Reasons Gobankingrates

11 Best Free Online Stock Average Down Calculator Websites

How To Price A Product In 3 Simple Steps 2022

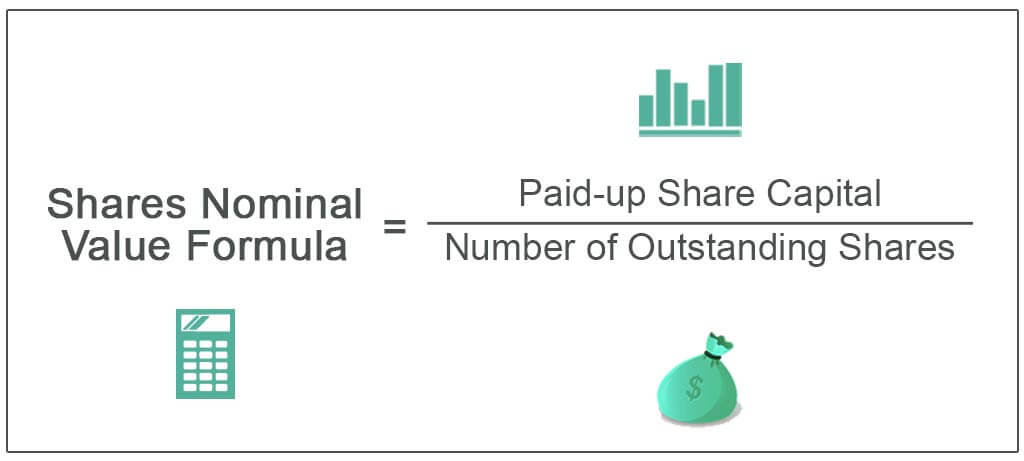

Nominal Value Of Shares Meaning Formula How To Calculate

How To Figure Net Change Percentage For Stocks

Inventory Days Formula How To Calculate Days Inventory Outstanding

How To Calculate Safety Stock Video Formulas Calculator

How To Calculate Percentage Increase Of A Stock Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate Market Price Change Of Common Stock

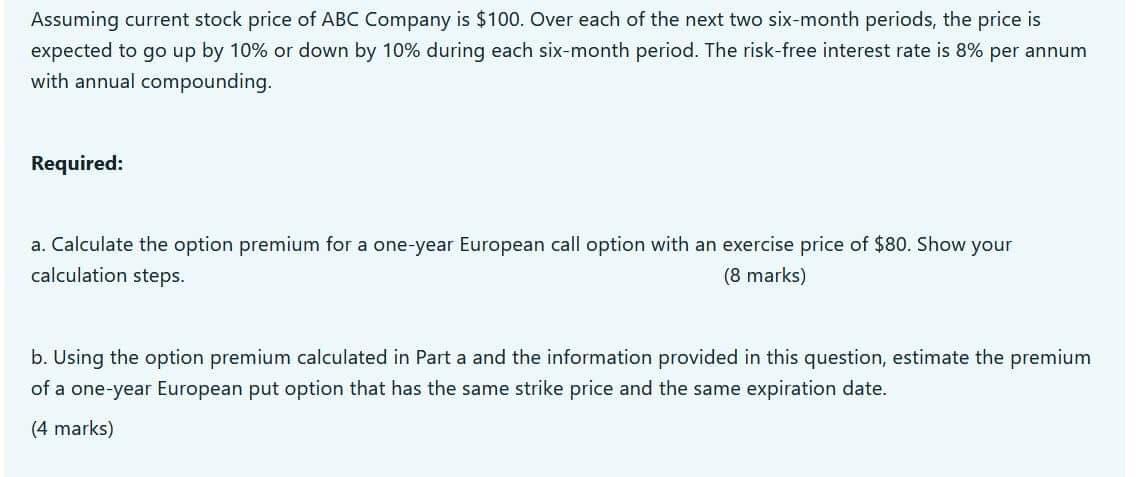

Solved Assuming Current Stock Price Of Abc Company Is 100 Chegg Com

Common Stock Formula Calculator Examples With Excel Template

How To Calculate Payoffs To Option Positions Video Lesson Transcript Study Com

Percentage Change Formula Calculator Example With Excel Template

Internal Rate Of Return Irr Definition Calculation How To Use It

How To Calculate The Perfect Product Selling Price Formula Included

:max_bytes(150000):strip_icc()/Price-to-EarningsRatio-7d1fd312f58843e2b668c71f85b6a697.jpg)